Beyond Stocks: Exploring Alternative Investing Opportunities

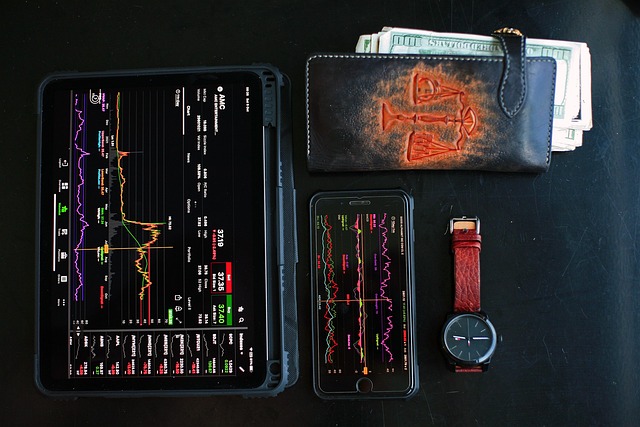

Investing is often synonymous with stocks, bonds, and mutual funds. However, the world of investing is vast, offering a plethora of opportunities that extend well beyond the traditional avenues. As markets evolve and new assets gain traction, diversification has become a key strategy for investors seeking to enhance returns and mitigate risks. This article delves into various alternative investing opportunities, including real estate, commodities, cryptocurrencies, private equity, and more. By exploring these options, investors can broaden their horizons and better position themselves for financial success.

The Appeal of Alternative Investments

Alternative investments have gained popularity for several reasons. The most compelling factor is the potential for higher returns when compared to traditional investments. Many alternative assets exhibit low correlation with the stock market, which can serve to balance portfolio volatility. Moreover, the rise of technology and accessibility has democratized many of these investment opportunities, allowing individual investors to participate in markets that were once restricted to institutional players.

Real Estate: A Tangible Asset Class

Real estate investment has long been a favored method of wealth building. This tangible asset class can provide steady cash flow, tax advantages, and long-term appreciation. Investors have various options when it comes to real estate:

Direct property ownership involves buying residential or commercial properties to rent or sell. This requires thorough market research, property management skills, and adequate capital for acquisitions and maintenance.

Real Estate Investment Trusts (REITs) provide an alternative for those looking to invest in real estate without the hassles of direct ownership. REITs allow investors to purchase shares of companies that own, operate, or finance income-generating real estate. This investment vehicle offers liquidity, as shares can be traded like stocks, and typically pays dividends.

Real estate crowdfunding platforms have emerged, allowing multiple investors to pool their resources to fund real estate projects. This model lowers the barrier to entry and provides a way for individuals to participate in larger projects.

Commodities: Investing in Physical Goods

Commodities are physical goods that include agricultural products, metals, and energy resources. Investing in commodities can act as a hedge against inflation and economic downturns. Investors can gain exposure to commodities through direct purchasing, futures contracts, or commodity-focused funds.

Precious metals like gold and silver are popular among investors during times of economic uncertainty. They serve as a safe haven, helping to preserve wealth when other assets decline.

Agricultural commodities, including grains and livestock, also present opportunities for diversification. As global demand for food increases, investing in these commodities may yield significant returns.

Cryptocurrencies: The Digital Frontier

The rise of cryptocurrencies has revolutionized the financial landscape. Digital currencies like Bitcoin, Ethereum, and countless altcoins present a new realm of investment. Crypto markets are highly volatile, offering both significant risks and rewards.

Investing in cryptocurrencies can take many forms, including direct purchases, trading on exchanges, and participating in Initial Coin Offerings (ICOs). Additionally, decentralized finance (DeFi) has emerged, offering users opportunities to lend, borrow, and earn interest on their cryptocurrency holdings.

While the potential for high returns exists, great caution is advised due to the regulatory uncertainties and volatility associated with this asset class. Investors must conduct thorough research and be prepared for market fluctuations.

Private Equity: Investing in the Future of Companies

Private equity refers to investments made directly in private companies or buyouts of public companies, leading to their delisting from public stock exchanges. This form of investing typically requires a longer-term commitment but can yield exceptional returns. Private equity firms often seek operational improvements in the companies they invest in, driving value creation over time.

Investors can participate in private equity through various channels, including venture capital (which focuses on early-stage companies) and growth equity (targeting more established companies seeking expansion). Accessing private equity opportunities often requires substantial upfront capital, making it more suitable for accredited investors or institutional players.

Hedge Funds: Combining Strategies for Potential Gains

Hedge funds are investment funds that employ various strategies to generate high returns, often irrespective of market conditions. These strategies may include long/short equity, quantitative analysis, and event-driven investing.

Hedge funds are typically open to accredited investors and may require a high minimum investment. Their structure allows for diverse investment approaches, making them an interesting alternative for sophisticated investors willing to accept higher levels of risk.

Collectibles: Tangible Assets with Emotional Value

Collectibles, such as art, antiques, coins, stamps, and vintage wines, have been a source of investment for centuries. These assets often carry emotional and historical significance, which can drive demand and, consequently, prices over time.

Investing in collectibles requires a deep understanding of the market and the specific items being purchased. While their value can rise significantly, it is essential to consider factors like authenticity, condition, and demand trends.

Peer-to-Peer Lending: Direct Borrowing and Investing

Peer-to-peer (P2P) lending platforms enable individuals to lend money directly to borrowers while bypassing traditional financial institutions. Investors earn interest on their loans, creating an opportunity for passive income.

This alternative investment is attractive due to its accessibility and the potential for higher returns than traditional savings accounts. However, lending to individuals carries risks, including the likelihood of default. Therefore, due diligence is essential when selecting borrowers.

Impact Investing: Profit with Purpose

Impact investing aims to generate social or environmental benefits alongside financial returns. This investment strategy appeals to those looking to align their financial goals with their values. Investments can range from renewable energy projects to affordable housing initiatives.

Impact investing has gained traction as more investors seek to contribute positively to society. While these projects may not always offer immediate financial gains, the long-term benefits can be significant, both financially and ethically.

Finding Your Niche: Deciding on Alternative Investments

As you explore the diverse world of alternative investments, it is essential to assess your risk tolerance, time horizon, and financial goals. Each alternative investment comes with inherent risks and returns that require careful evaluation.

Start by conducting thorough research on each asset class that piques your interest. Consider the market dynamics, potential returns, and accessibility of these investments. Joining online communities, attending seminars, and networking with other investors can provide valuable insights and recommendations.

Diversification is a critical principle of investing, and alternative investments can play a key role in building a balanced and resilient portfolio. By combining various asset classes, you can reduce risk while exploring new opportunities for growth.

Conclusion

While traditional stocks will always have a place in the investment landscape, exploring alternative investments is essential for those looking to enhance their portfolios. From real estate and commodities to cryptocurrencies and peer-to-peer lending, a wealth of opportunities exists beyond the stock market. Each alternative investment comes with its risks and returns, so careful research and planning are imperative.

As the financial world continues to evolve, staying informed about alternative opportunities will allow investors to adapt and thrive, pursuing pathways to financial success that resonate with their individual goals and values.