Navigating the Seas of Investing: A Beginner’s Guide

Investing can often seem like a daunting task, especially for beginners. With a myriad of options and strategies, it’s easy to feel overwhelmed by the prospect of entering the world of finance. However, understanding the basics of investing is essential for anyone looking to build wealth and secure their financial future. This guide aims to demystify investing, outlining key concepts and providing practical advice to help beginners set sail on their investment journey.

Understanding the Basics of Investing

At its core, investing is the act of allocating resources, usually money, in order to generate a return or profit. This can take many forms, from purchasing stocks and bonds to real estate or mutual funds. The fundamental goal is to increase the value of your investments over time, often through capital appreciation and income generation.

Investing differs from saving, which is typically a means of preserving money for future use, often in a bank account where it earns minimal interest. While saving is an important financial practice, investing tends to offer higher potential returns, albeit with increased risk.

Investment Vehicles: Options for Every Investor

Investors have a variety of investment vehicles to choose from, each with its own risk profile, return potential, and liquidity. Understanding these options is crucial for making informed investment decisions.

Stocks

Stocks represent ownership in a company. When you purchase shares, you’re buying a piece of the business. Stocks are often considered high-risk investments, but they also offer the potential for significant returns over time. The stock market is volatile, meaning that share prices can fluctuate dramatically based on market conditions and company performance.

Bonds

Bonds are essentially loans you make to a government or corporation in exchange for periodic interest payments plus the return of the bond’s face value at maturity. Bonds are typically considered safer than stocks, making them an attractive option for more risk-averse investors. However, they usually offer lower returns compared to stocks.

Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and ETFs are pooled investment vehicles that allow investors to buy a diversified portfolio of assets. Mutual funds are managed by professional fund managers, while ETFs are traded on stock exchanges and typically track an index. Both options provide diversification, which can help mitigate risk.

Real Estate

Real estate investing involves purchasing properties for rental income or resale. It can provide consistent cash flow and serve as a hedge against inflation. However, real estate investing requires substantial capital and comes with various risks, including property management challenges and market downturns.

The Importance of Risk Assessment

Risk assessment is a critical component of investing. Different investment types come with different levels of risk, and understanding your risk tolerance is essential for shaping your investment strategy. Risk tolerance can be influenced by factors such as your financial goals, time horizon, and personal comfort with market volatility.

It’s important to note that higher potential returns usually come with higher risks. A well-balanced portfolio often includes a mix of high-risk and low-risk investments, allowing for growth while minimizing potential losses.

Setting Investment Goals

Before diving into the world of investing, it’s essential to establish clear investment goals. Knowing what you aim to achieve will guide your choices and keep your strategy aligned with your long-term financial objectives. Common investment goals include:

- Saving for retirement

- Building an emergency fund

- Saving for a major purchase, such as a home or car

- Funding a child’s education

Each goal will have a different time horizon and risk profile, influencing the type of investments you choose. For example, long-term goals like retirement can generally withstand more volatility, allowing for greater allocation towards equities, whereas short-term goals may require more conservative investments.

The Power of Compounding

One of the most compelling reasons to start investing early is the power of compounding. Compounding refers to the process of generating earnings on previously earned interest or investment returns. Over time, this can significantly amplify your investment growth.

For example, if you invest $1,000 at an annual return of 5%, after 30 years, your investment will grow to approximately $4,300 due to compounding. The longer your money remains invested, the more you benefit from this exponential growth.

Diversification: Spreading Your Risk

Diversification is a crucial strategy for managing risk in your investment portfolio. By spreading your investments across various asset classes or sectors, you can reduce the impact of poor-performing investments on your overall portfolio. While diversification does not eliminate risk entirely, it can help mitigate it, allowing for a more stable long-term growth trajectory.

When diversifying, consider including a mix of stocks, bonds, real estate, and other investment options. Within each category, invest in different industries and regions to further enhance your diversification strategy.

Investment Strategies: Finding Your Approach

Several investment strategies can guide beginners in their decision-making. While there is no one-size-fits-all approach, understanding different strategies can help you find the right fit for your goals and risk tolerance.

Buy and Hold

This strategy involves purchasing investments and holding them for an extended period, regardless of market fluctuations. This approach capitalizes on the long-term growth potential of assets, allowing investors to ride out market volatility.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the investment’s price. This method can reduce the impact of market volatility by averaging out the cost of your investments over time.

Value Investing

Value investing focuses on identifying undervalued stocks that are trading for less than their intrinsic value. Investors seek stocks with strong fundamentals and solid growth potential, aiming to buy low and sell high.

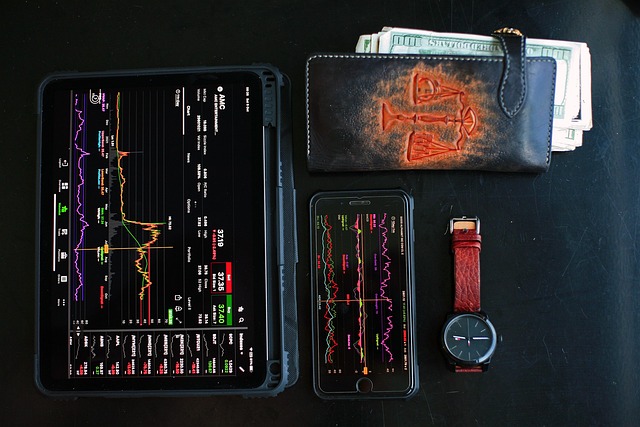

Tech Tools and Resources for Investors

Technology has transformed the investing landscape, providing beginners with a wealth of resources at their fingertips. Several online platforms and apps streamline the investing process and enhance accessibility.

Robo-advisors, for example, automatically manage investment portfolios based on your risk tolerance and goals, often at a lower cost than traditional financial advisors. Furthermore, investment tracking tools and educational platforms offer valuable information and insights to help you make informed decisions.

The Role of Emotional Intelligence in Investing

Investing is not only a financial endeavor but also an emotional one. Market fluctuations can invoke fear and greed, which may lead to impulsive decisions. Maintaining emotional intelligence is vital for investors. Being aware of your emotions and understanding how they can influence your thinking will help you stay focused on your long-term goals.

Stick to your investment plan, avoid making decisions based on short-term market movements, and remain disciplined in your approach.

Continuous Education and Adaptability

The financial markets are dynamic and ever-evolving. To navigate the seas of investing successfully, it’s essential to commit to continuous education. Stay informed about market trends, economic indicators, and emerging investment opportunities. Read books, attend seminars, and utilize online resources to expand your knowledge.

Moreover, be adaptable. As you gain experience and your financial situation changes, your investment strategy may require adjustments. Regularly reviewing and rebalancing your portfolio ensures that it remains aligned with your goals and risk tolerance.

Conclusion: Setting Sail on Your Investment Journey

Navigating the world of investing may seem intimidating at first, but with a solid understanding of the fundamentals, clear goals, and a well-thought-out strategy, even beginners can find success in their investment endeavors. Start small, educate yourself, and remember that patience and discipline are key components of a successful investment journey. As the saying goes, “Time in the market beats timing the market.” So set sail on your investment journey, and may your financial future be bright.