The Art of Investing: Strategies for Success in Uncertain Times

Investing has long been regarded as both an art and a science. It requires a deep understanding of financial markets, the ability to interpret data, and an intuition for making calculated risks. As we navigate through uncertain times—marked by economic fluctuations, geopolitical tensions, and unforeseen global events—the importance of having a solid investment strategy becomes paramount. This article explores various strategies that can lead to success in investments, especially when the landscape is unpredictable.

Understanding the Current Economic Climate

Before diving into specific investment strategies, it is essential to understand the current economic environment. The global economy has been shaped by numerous factors, including but not limited to:

- Inflation rates that influence purchasing power.

- Interest rates that affect borrowing costs.

- Market volatility due to geopolitical conflicts.

- Shifts in consumer behavior post-pandemic.

- Technological advancements driving new opportunities.

Awareness of these factors can enhance investors’ ability to respond to changes in the market and adjust their strategies accordingly.

Building a Robust Investment Strategy

Creating an investment strategy is akin to painting a masterpiece; it requires a well-thought-out plan, an understanding of different tools, and adjustments along the way. Here we explore essential components of a robust investment strategy.

Diversification: The Cornerstone of Risk Management

Diversification is critical when navigating uncertain times. By spreading investments across various asset classes—such as stocks, bonds, real estate, and commodities—investors can mitigate potential losses. The principle behind diversification is simple: when one investment struggles, others may perform well, thus balancing the overall portfolio.

Consider including international assets in your portfolio, as they may perform independently of domestic markets, providing a buffer against local downturns. Additionally, incorporating alternative investments, such as hedge funds, private equity, and even cryptocurrencies, can offer potential returns that are uncorrelated with traditional assets.

Focusing on Value Investing

In uncertain times, value investing can prove effective. This strategy involves identifying undervalued stocks or assets with strong fundamentals, such as sound management and solid earnings. Investors can take advantage of market inefficiencies by purchasing these undervalued assets with the expectation that their value will rise over time.

Warren Buffett, one of the most renowned investors, famously stated, “Price is what you pay; value is what you get.” By concentrating on companies with a strong competitive edge and long-term growth prospects, investors can make informed decisions that withstand market unpredictability.

Embracing a Long-Term Perspective

During uncertain times, it’s easy for investors to get caught up in short-term market fluctuations, leading to emotional decisions. A long-term mindset allows investors to ride out volatility and focus on their financial goals. By remaining patient and avoiding impulsive reactions to market downturns, investors can benefit from the power of compounding returns over time.

It’s crucial to establish clear financial goals and a timeline for achieving them. Whether saving for retirement, a major purchase, or building wealth, having a long-term perspective helps keep investors grounded during turbulent periods.

The Role of Research and Analysis

Knowledge is power in the world of investing. Thorough research and analysis are essential components of a successful investment strategy. Investors should take the time to analyze potential investments, looking at macroeconomic trends, industry developments, and company-specific data.

Utilizing financial tools and resources, such as stock screeners, financial news, and expert recommendations, can aid in the decision-making process. Furthermore, following credible analysts and reports can provide insights into market trends and potential investment opportunities.

Keeping Emotions in Check

Investing can elicit a range of emotions, from excitement during market upturns to fear during downturns. Successful investors recognize the importance of maintaining emotional discipline. Basing decisions on data and analysis rather than emotions can prevent impulsive actions that may lead to poor investment choices.

Setting predefined rules for buying and selling assets, implementing stop-loss orders, and limiting exposure to volatile investments can help manage emotional reactions. Regularly reviewing and rebalancing a portfolio is also crucial to ensure alignment with investment objectives.

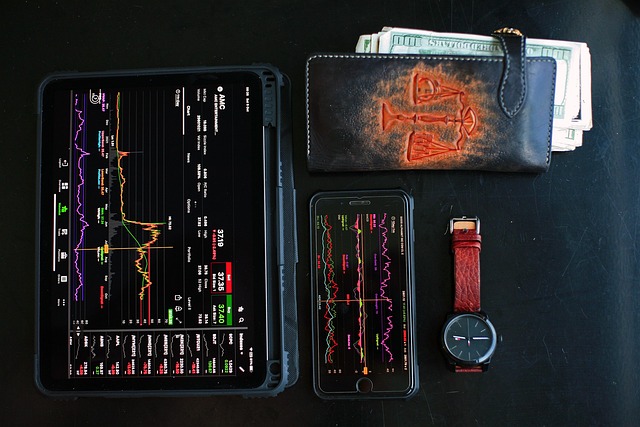

Leveraging Technology for Investment Decisions

In the digital age, technology plays a significant role in enhancing investment strategies. Online trading platforms, robo-advisors, and financial apps offer investors tools to analyze markets, track portfolio performance, and execute trades with ease. Utilizing advanced algorithms and artificial intelligence can help investors identify trends and potential opportunities that might go unnoticed in traditional analyses.

Moreover, engaging with online investment communities and forums allows investors to share insights, strategies, and experiences. Collaboration and knowledge-sharing can provide an additional layer of support and information that fuels informed decision-making.

Conclusion

The art of investing is a complex blend of strategy, knowledge, and psychological resilience. In uncertain times, investors must adapt their methods, embrace diversification, focus on value, and maintain a long-term perspective. By leveraging research, technological advancements, and emotional discipline, investors can navigate the unpredictable waters of finance with greater confidence.

Ultimately, the journey of investing is personal. Each investor must develop their approach based on their financial goals, risk tolerance, and market conditions. Success in investing is not solely defined by returns but also by the ability to remain steadfast amidst uncertainty. In doing so, investors can not only safeguard their wealth but also position themselves for future growth when the market stabilizes.