The Rise of Sustainable Investing: A New Paradigm

In recent years, the world of finance has experienced a dramatic transformation, with sustainable investing emerging as a leading trend among investors. This shift is more than just a fleeting fashion; it signals a profound evolution in how individuals and institutions approach wealth creation and management. With increasing awareness of environmental, social, and governance (ESG) issues, sustainable investing is shaping a new paradigm—one that prioritizes long-term impact alongside financial returns.

Understanding Sustainable Investing

Sustainable investing refers to investment strategies that consider both financial returns and the broader societal impact. It encompasses a range of practices, including responsible investing, socially responsible investing (SRI), and impact investing. Essentially, it aligns investment goals with ethical considerations, seeking to promote sustainable economic growth while addressing pressing global challenges.

At the heart of sustainable investing is the notion that financial markets can drive positive change. Investors are increasingly searching for opportunities that not only yield returns but also contribute to social equity, environmental stewardship, and corporate responsibility. As the world grapples with issues such as climate change, income inequality, and social justice, sustainable investing presents a viable solution to tackle these challenges while generating profit.

The Forces Driving Sustainable Investing

The rise of sustainable investing can be attributed to a confluence of factors, including growing investor awareness, regulatory changes, technological advancements, and a shift in corporate behavior. Each of these elements plays a significant role in reshaping the investment landscape.

Growing Investor Awareness

Millennial and Gen Z investors are particularly drawn to sustainable investing. With access to information at their fingertips, these younger generations prioritize their values and seek out investment opportunities that reflect their commitment to sustainability. They recognize that their investment choices can influence corporate behavior and bring about meaningful change.

Regulatory Changes

Governments and regulatory bodies worldwide are increasingly recognizing the importance of sustainability in finance. Initiatives such as the European Union’s Sustainable Finance Action Plan and the Task Force on Climate-related Financial Disclosures (TCFD) have set frameworks that encourage businesses and investors to incorporate ESG factors into their decision-making processes. These regulations aim to enhance transparency and accountability, making it easier for investors to assess the sustainability of their portfolios.

Technological Advancements

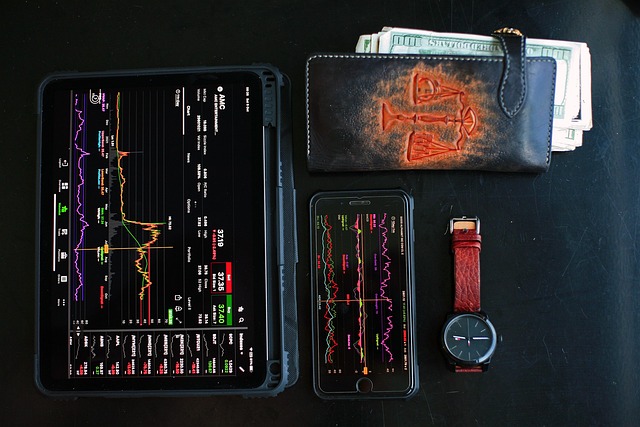

The rise of fintech and data analytics has democratized access to investment information. Innovative platforms provide investors with insights into the ESG performance of companies and funds, facilitating informed investment choices. Additionally, advancements in artificial intelligence and big data enable more precise risk assessments related to sustainability, further empowering investors.

A Shift in Corporate Behavior

In response to growing pressure from stakeholders, many corporations are adopting sustainable practices. Companies are recognizing that integrating sustainability into their operations is not merely a moral obligation but a competitive advantage. Firms that prioritize sustainability often enjoy enhanced reputation, increased customer loyalty, and improved risk management. This shift has generated a ripple effect, encouraging more investors to seek out businesses committed to sustainable practices.

Types of Sustainable Investing

Sustainable investing encompasses various strategies, each with a unique approach to integrating ESG factors. Investors can choose from a range of options depending on their objectives, values, and risk tolerance.

Negative Screening

This strategy involves excluding specific industries or companies from investment portfolios based on ethical considerations. Common exclusions may include sectors such as tobacco, firearms, or fossil fuels. Negative screening allows investors to align their portfolios with their personal values while avoiding companies that do not meet their sustainability criteria.

Positive Screening

Unlike negative screening, positive screening focuses on selecting companies that perform well in terms of ESG metrics. Investors actively seek out businesses that excel in sustainable practices, such as renewable energy firms or those with strong corporate social responsibility programs. This approach fosters investment in organizations that contribute positively to society and the environment.

Impact Investing

Impact investing goes a step further by specifically targeting projects or companies that generate measurable social or environmental benefits alongside financial returns. This strategy often involves investing in initiatives related to clean water, affordable housing, or education. Impact investors prioritize measurable outcomes, ensuring their capital directs positive change in areas of critical need.

ESG Integration

ESG integration involves systematically incorporating ESG factors into investment analysis and decision-making. This strategy recognizes that sustainability issues can significantly affect financial performance. By evaluating ESG risks and opportunities, investors can make more informed choices that align with their long-term investment goals.

The Benefits of Sustainable Investing

Sustainable investing offers a multitude of benefits that extend beyond financial performance. Some of these advantages include:

- Risk Management: By considering ESG factors, investors can identify potential risks associated with environmental changes, regulatory compliance, and social unrest. This proactive approach often leads to more resilient investment portfolios.

- Long-Term Performance: Research has shown that companies prioritizing sustainability often deliver stronger long-term performance. With increasing consumer demand for ethical practices, businesses that embrace sustainability tend to enjoy a competitive edge.

- Alignment of Values: Sustainable investing enables individuals to align their investment choices with their personal values, creating a sense of purpose and fulfillment in their financial decisions.

- Positive Societal Impact: By investing in companies and initiatives that contribute to social and environmental well-being, investors play a direct role in addressing global challenges, fostering a more equitable and sustainable future.

Challenges and Criticisms

Despite its many advantages, sustainable investing is not without challenges and criticisms. Some of the most notable concerns include:

Greenwashing

Greenwashing refers to the practice of companies falsely portraying themselves as sustainable or environmentally friendly. This misleading behavior can make it challenging for investors to identify genuinely sustainable investments. Without stringent regulations and transparent reporting standards, investors may inadvertently support companies that do not live up to their claims.

Performance Concerns

Critics often question whether sustainable investments can deliver competitive financial returns comparable to traditional investments. However, a growing body of research suggests that companies with strong ESG practices often outperform their peers over the long term. While there may be short-term fluctuations, sustainable investing is increasingly being recognized as a prudent financial strategy.

Lack of Standardization

The absence of universally accepted metrics and reporting standards for ESG factors poses a significant barrier to sustainable investing. With various ratings agencies and methodologies, investors can encounter inconsistencies and confusion when assessing the sustainability of their portfolios.

The Future of Sustainable Investing

As awareness of the importance of sustainability continues to grow, the future of sustainable investing looks promising. The integration of ESG factors into traditional investment frameworks will likely become standard practice across the financial industry. With a greater emphasis on transparency and accountability, investors can expect improved access to reliable ESG data, enabling more informed decision-making.

Additionally, as technology continues to advance, investors will benefit from innovative solutions that facilitate sustainable investment analysis and monitoring. Data analytics and artificial intelligence will enhance the ability to evaluate the impact of sustainability metrics on financial performance, further solidifying sustainable investing’s credibility.

Moreover, the rise of stakeholder capitalism is changing corporate behavior. Companies are increasingly recognizing their responsibilities toward all stakeholders, not just shareholders. This shift may lead to a more holistic approach to business, where sustainability is integrated into the core mission and strategy of companies across all sectors.

Conclusion

The rise of sustainable investing represents a cultural shift in how investors approach their financial decisions. It embodies a growing recognition that profits can coincide with purpose, creating a more sustainable and equitable world. As this paradigm continues to evolve, investors, corporations, and governments will play crucial roles in shaping a future that embraces sustainability as a fundamental principle of finance. By integrating ESG factors into investment strategies, stakeholders can contribute to positive change while working toward achieving long-term financial goals.